23and...RGC

Speculative musings on what Regeneron might be up to with 23andMe

Yesterday REGN announced that it has entered into an agreement to acquire the assets of consumer genomics business 23andMe, out of bankruptcy. So far as I recall, this is only REGN’s fourth acquisition in its 37 year history, which is extraordinary when you think about it. At the princely sum of $256m it’s also a contender for REGN’s most extravagant acquisition yet (depending on how the contingent part of the Decibel deal works out).

Per the PR, the plan is “to strengthen Regeneron’s ongoing leadership in genetics-guided research and drug development to help people with serious diseases.”

Additionally:

Regeneron intends to acquire 23andMe’s Personal Genome Service® (PGS), Total Health and Research Services business lines, together with its Biobank and associated assets, for $256 million and for 23andMe to continue all consumer genome services uninterrupted. Subject to bankruptcy court and regulatory approvals and other customary closing conditions, the transaction is expected to close in the third quarter of 2025.

While 23andMe’s woes had been widely publicised and the business was looking for buyers, I cannot claim to have anticipated a deal with REGN. In some ways it does kind of make sense - 23andMe has a large databank which can presumably be tied into Regeneron Genetic Center’s own (RGC) in order to generate valuable insights. If you haven’t seen it yet, please check out my deep dive where I discuss what REGN’s totally unique RGC operation does.

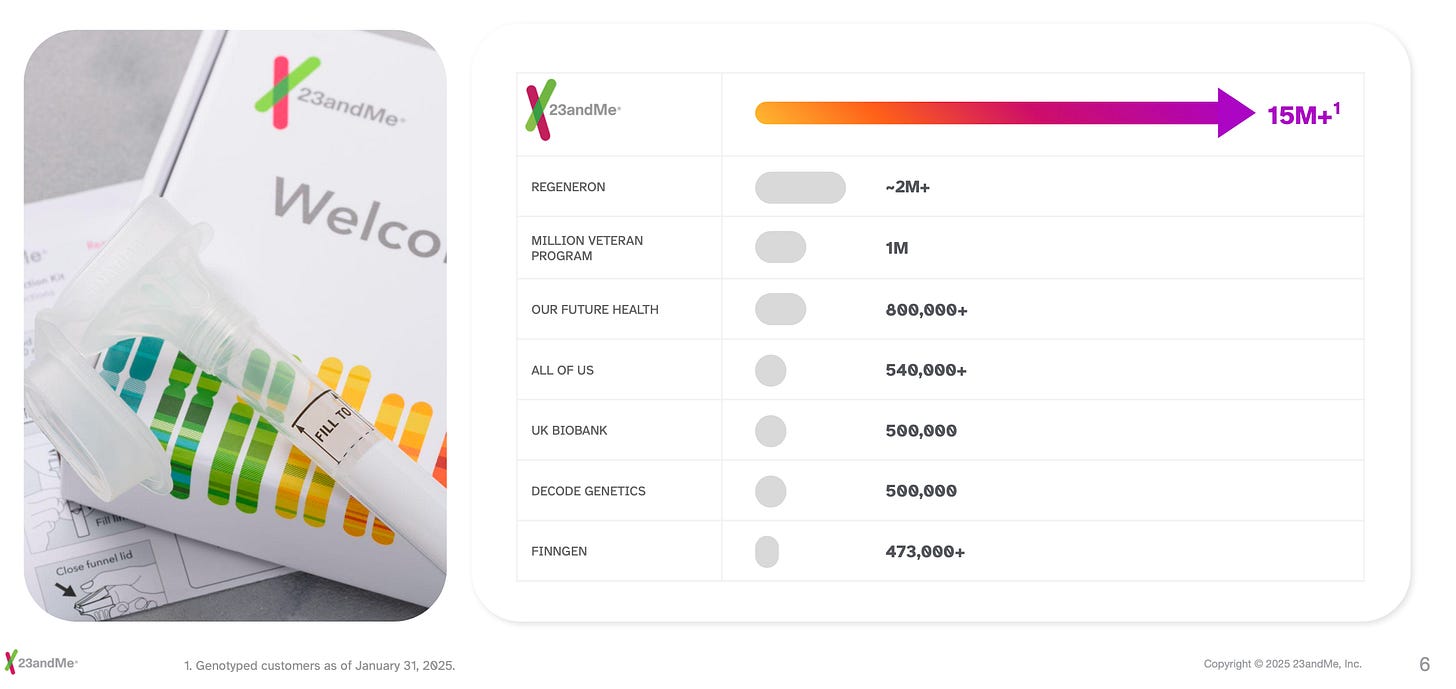

Per one journalist “even if [the deal] helps contribute to the discovery or development of just one drug, it will likely have been a bargain.” Can’t really disagree with that. But the thing is, 23andMe is primarily a genotyping business meaning that their tests typically only cover a tiny fraction of the genome. RGC has primarily sequenced exomes (protein-coding regions) historically while increasingly adopting whole genome sequencing (WGS) more recently. The reason - genotyping has been far cheaper than sequencing historically. Be that as it may, RGC’s databank of three million exomes tied to anonymised health care records, is most likely a much more powerful resource than 23andMe’s larger pool of genotyped customers.

As noted in my deep dive REGN recently announced plans to add another 10 million individuals to RGC’s databank. And in a follow-up interview George Yancopoulos said he then wants to get to 50 million individuals and beyond. My initial reaction to the 23andMe deal was that they’re in it for the existing databank, and only taking the consumer side to get the deal across the line. But what if the consumer side is part of George’s plan to become the first genome hyperscaler?

It’s tough to know with any precision but the 2023 10K said RGC had sequenced “more than 2 million” samples by that date, whereas the 2024 10K says “nearly 3 million” - suggesting annualised processing capacity in the ballpark of one million - surely far in excess of what anyone else is capable of. While it’s not discussed much at all, RGC has also quietly become a leader in lab automation, robotics and various aspects of large-volume data processing in the cloud. If anyone can process extraordinarily large numbers of sequencing samples, quickly and cheaply - it’s RGC. And that’s just the logistical side.

On the sequencing side itself. We know that RGC was an early adopter of Ultima Genomics’ high throughput/low-cost sequencing instruments and is now using them at scale. Additionally, Ultima recently announced the $80 genome and have suggested they intend to keep going lower. Moreover, REGN is itself an investor in Ultima and presumably have a pretty good idea of the roadmap. You have to wonder therefore if RGC could take 23andMe much more aggressively into valuable exomes than was previously the case - and to do so cost-effectively.

23andMe was clearly not a good standalone business despite various efforts to turn itself around and make the whole thing work - it lost money every year and that’s why it eventually ran out. This gives rise to a couple of possibilities/questions:

REGN uses 23andMe as a funnel for channelling more data into RGC. As things stand, RGC today is an R&D entity probably without any meaningful revenue of its own - in this light 23andMe could also be seen effectively as an R&D operation. It would not matter, therefore, if 23andMe continues to lose money so long as the sums invested by REGN ultimately turn into sufficiently valuable discoveries and marketable products (i.e. return on investment).

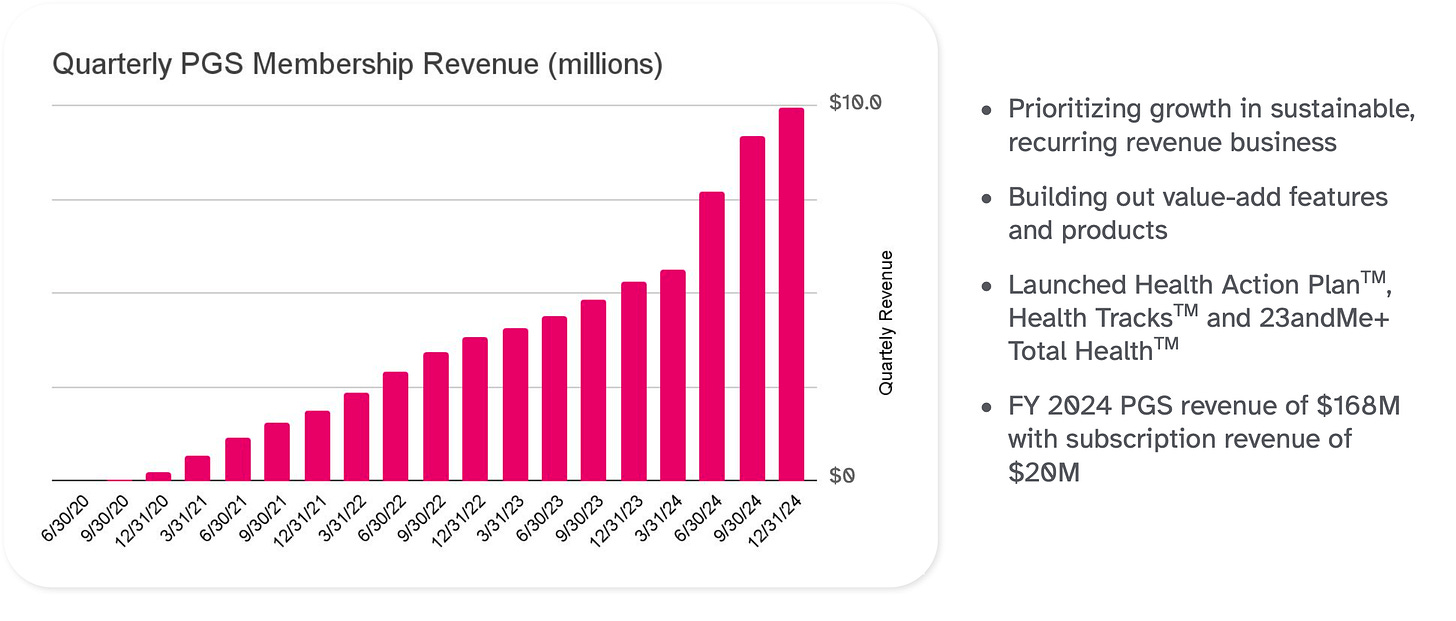

REGN uses 23andMe as an RGC funnel but also manages to turn it into a breakeven or profitable consumer business in its own right. This, of course, would depend on how low 23andMe could push its fixed and variable costs by benefiting from RGC’s scale and capabilities.

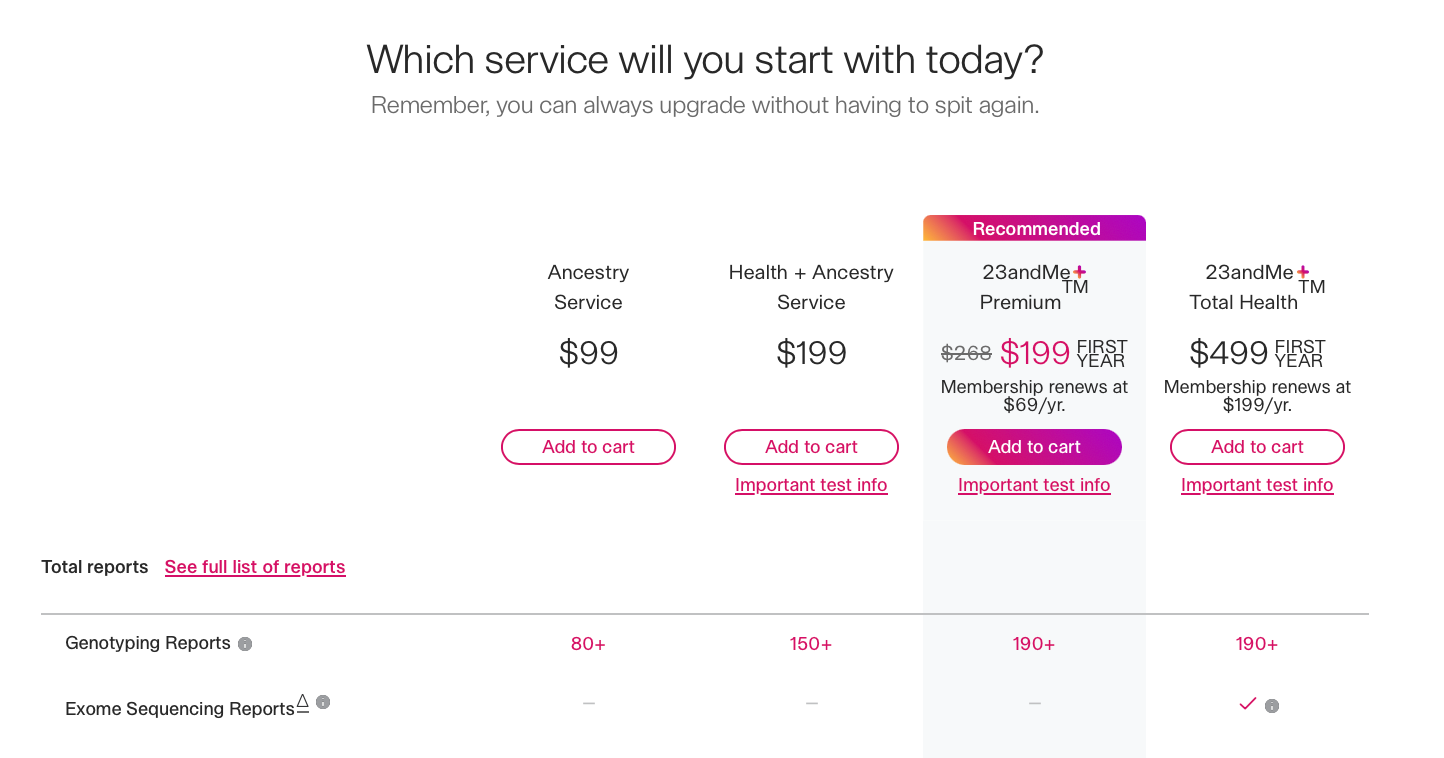

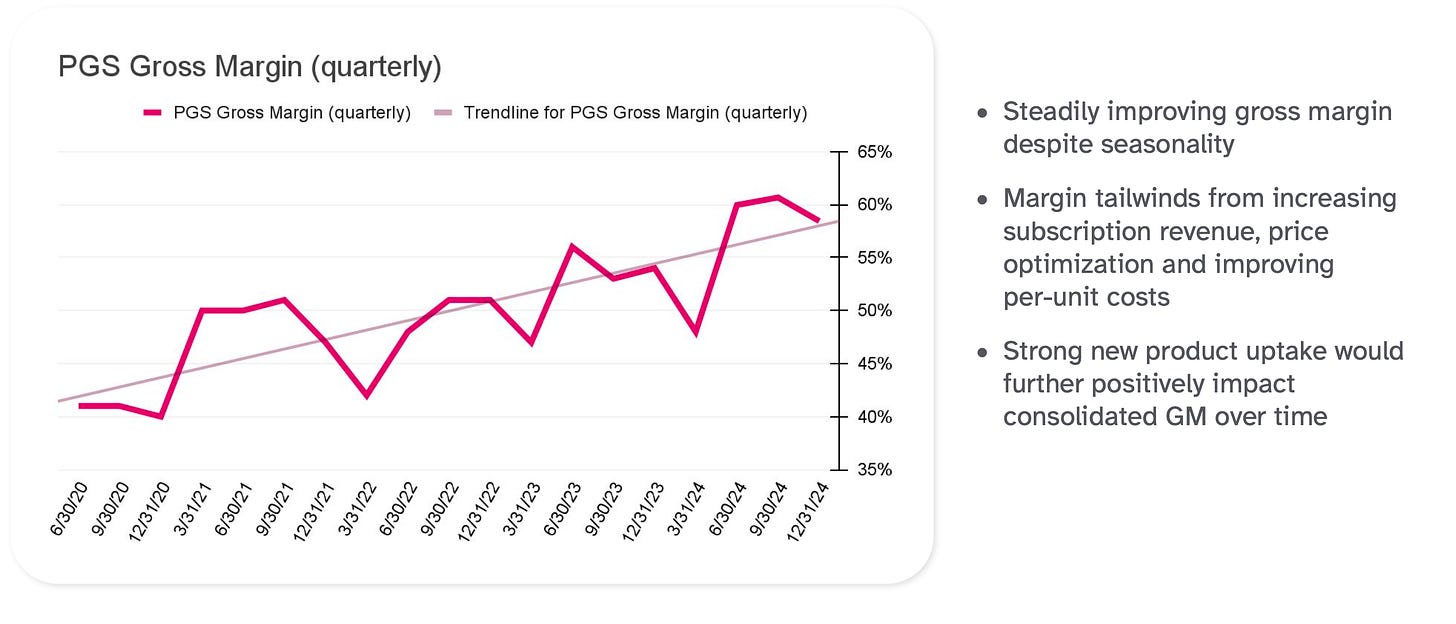

In both scenarios REGN would need to improve on 23andMe, which had stopped growing in any case. This suggests that 23andMe products/services need to be better and cheaper or in any case more widely adopted, whether through marketing or pushing into other channels. As it happens, 23andMe had itself been tilting in the direction of subscription services as well as a higher-priced exome service:

Increased exome sequencing could certainly lead to ultimately much improved insights relative to genotyping, and WGS better still, over time. RGC could even introduce an element of Olink-based proteomics, such as they are currently doing with UK Biobank. The lower they can drive cost per sample, the more they can do - including repeat sequencing.

Which also begs the question: Why not buy Ultima too? (I did say my musings would be speculative!). If you are to be a genomics hyperscaler, then it might make sense for you to make your own ‘chips’ too (much like AWS or Google) - that’s another path to driving down COGS.

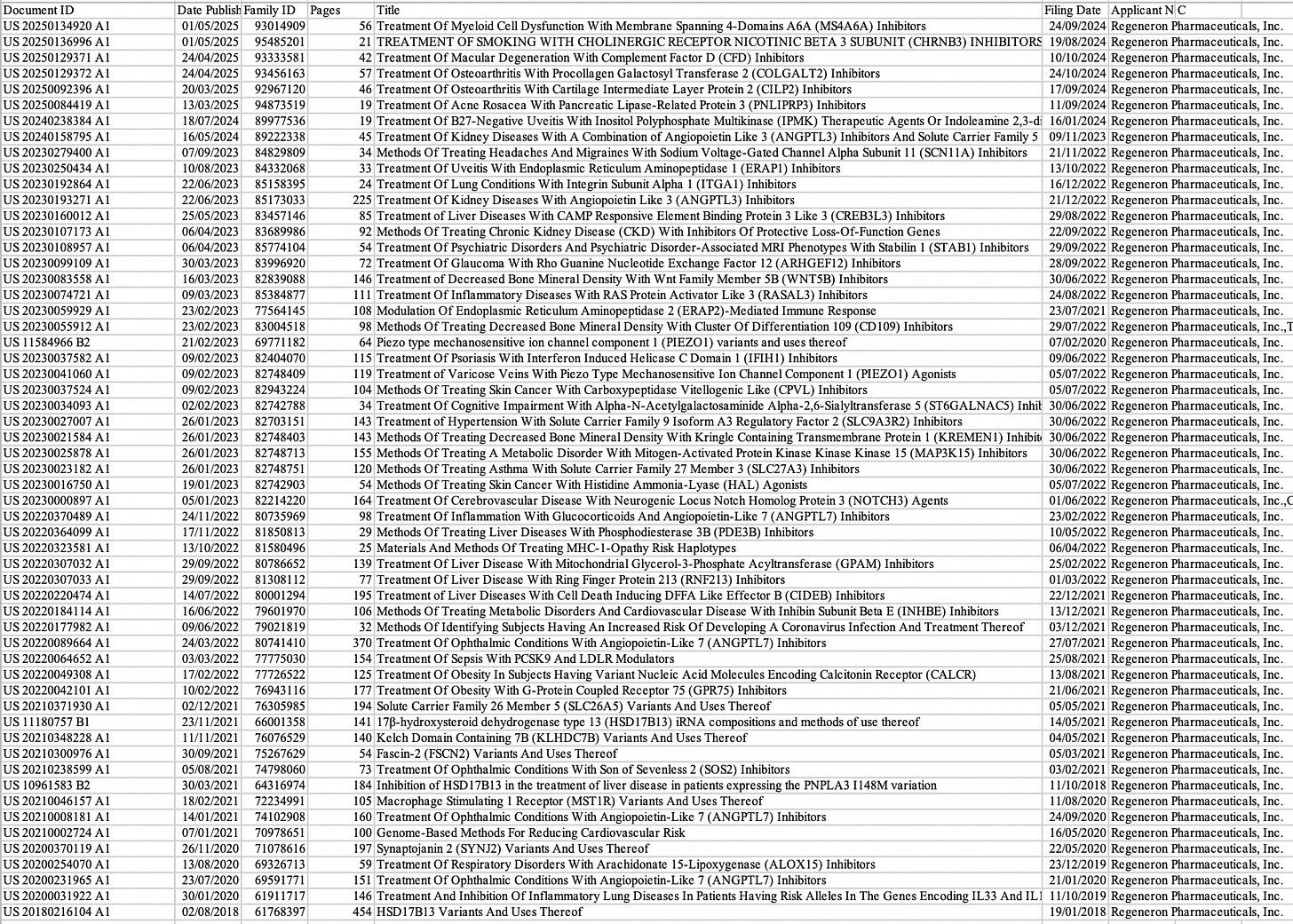

Just how far they could go, or what they could achieve - I have no idea. It’s all speculation until the deal closes and we learn more. But as a REGN shareholder, the idea is already growing on me. RGC is already a uniquely game-changing resource for REGN in my view - one that would be very tough to replicate. Here’s a list of patents that I assume have some degree of RGC origin (on the basis that RGC head Aris Baras is a named inventor):

This IP estate is only going to grow over time - and the bigger RGC’s dataset becomes, the greater the number of interesting insights that will ultimately translate into innovative therapies that help patients.

Of course, it’s probably fair to say that REGN knows little-to-nothing about running a DTC and app-based consumer business - they’re going to have to figure that part out and hire the right people. It won’t be easy. And in addition to that they’ll have to absorb 23andMe’s losses - these ran to ~$175m in 2024 before SBC, around half of which relating to therapeutic research (i.e. what REGN does). It’s not a huge sum relative to REGN’s size, but it will need to be managed.

As always, get in touch if you have any questions or thoughts.

I don't know if this is the best place to post this, but it looks like Regeneron is getting popular in fitnes (muscle gain) world:

https://www.youtube.com/watch?v=nB8qqiTmQc8