Notes From The Beauty Contest is a new investment blog that views current market dynamics through Keynes' newspaper beauty contest analogy. At NFTBC we will share deep dives on stocks, emphasizing a philosophy of "faithfulness" rather than trying to play the game.

Welcome to Deep Dive number three - Bruker Corporation ($BRKR). Also a warm welcome to new subscribers who have joined us since the last post a few weeks ago.

Despite previously announced intentions, it became increasingly clear in recent weeks/days that BRKR could be emerging as a nearer term opportunity so I decided to bring it forward in my agenda. To be honest, I had been putting off writing about BRKR. The company has a complex history and sells an intimidatingly large number of esoteric products - how does one write about a business like this and do it justice? My approach is to do it through my own lens, much like with REGN. We’re not going to go line-by-line through the products and neither will we tear apart the financials in painstaking detail. Rather than minutiae, we’re going to focus a bit more on the general to try to get to the bottom of questions such as - what makes BRKR special? My ambition here is to be able to take a motivated reader with little knowledge of BRKR up to a good level of understanding over the course of 45 minutes or so - please let me know if I succeed or fail.

For newcomers to NFTBC, please check out my intro piece here to learn about this blog and what the approach is. I’m publishing this deep dive mere days into a constantly fluctuating new tariff-based world order and BRKR shares have been falling like a stone. Regulars will know I don’t try to play the beauty contest guessing game as to where things are headed in the short-term. Please reach out if you think I’m wrong about something or have something to share. Let’s get going.

[Usual disclaimer - this isn’t intended as advice. Please do your own research. BRKR currently represents >10% of my portfolio.]

Introduction

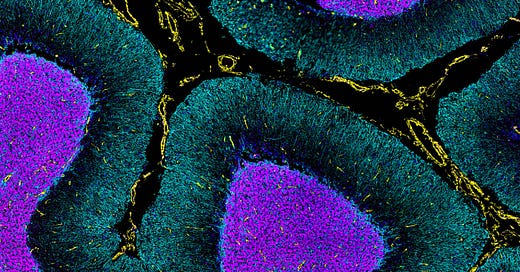

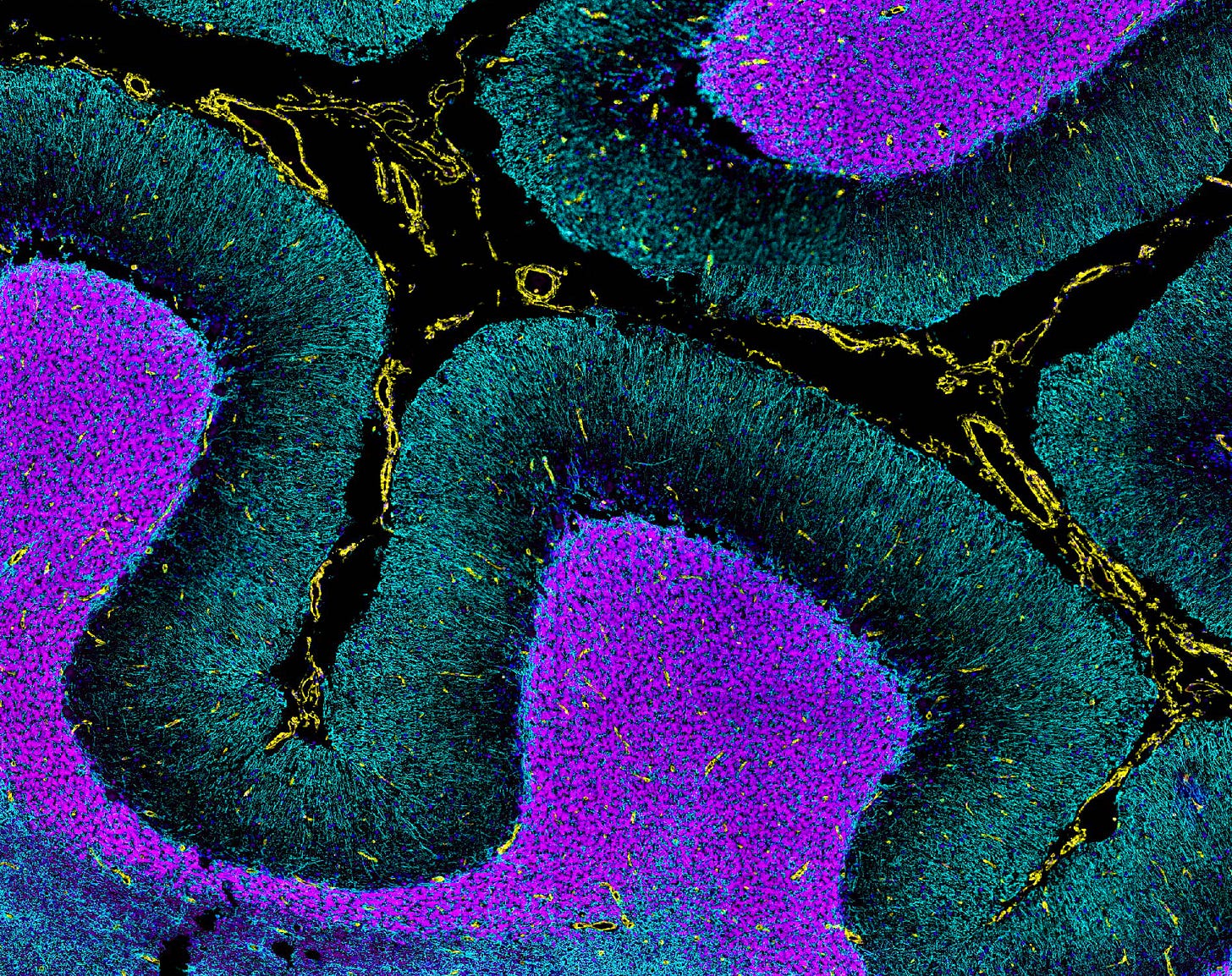

If you’re not already familiar, BRKR is a producer of high-end scientific instruments, listed on NASDAQ and based in Billerica, Massachusetts. Despite its legal domicile, the company is as much German as it is American, if not more so. It has strong Swiss roots too. BRKR’s biggest end market is in the life sciences, but, as we shall see, it does an awful lot more than that. In simple terms, the principal feature that BRKR’s products share is the ability to see things that are really hard to see - to enable customers to “to explore life and materials at microscopic, molecular and cellular levels”. The applications are broad: from making discoveries in the world of medicine to helping in the manufacture of the latest nanoscale semiconductors.

In February 2008 all of the various Bruker businesses existing at that time were reunited under a single entity, and I consider this to be the effective IPO date - we’ll get into that later. From 2008 to 2024 BRKR compounded its EPS by 10% p.a., revenue by close to 7% p.a. and averaged ~5.5% in organic revenue growth. Notably, it wasn’t until around 2014 that the earnings story really got going with >12% EPS CAGR from 2014-2024. The reason I find BRKR so compelling today is because the earnings growth story is far from over - it’s got a decade or more left to run most likely. Yet the shares are down >50% from their early 2024 highs and trade today at <15x consensus earnings, which I would argue is much too low for a double digit secular growth story.

So why the pessimism? BRKR made a couple of strategic but loss-making acquisitions - one in late 2023 and one in mid 2024. Both are guided to be EPS dilutive out to 2026, at which point they’ll turn neutral and then accretive. The fact that BRKR is able to turnaround such perennial loss-makers is a demonstration of the “Bruker Management System” at work. Be that as it may, the company is now well off the medium term earnings trajectory it set at the 2023 Investor Day. BRKR has traded shorter term pain for longer term gain, and the reason they can get away with it is because they have a controlling shareholder-CEO. But beyond this consideration, there are two principal bogeymen on the scene, as I write. The first is announced cuts in grants awarded by the NIH and questions around what happens to the NIH’s budget from here. With higher than average exposure to academic and government end markets, BRKR has long been a popular punching bag for short sellers when questions around the NIH arise - I won’t deny it’s a strategy that works. The second is the implementation of wide-ranging border tariffs in the US and the threat of reciprocation. My intention is to address these concerns much later on - my ambition with this note is that it will hopefully still be relevant to someone picking it up in three or four years and neither do I wish to send my readers to sleep so early on. Clearly the volatile emergence of a new US regime is going to shake things up a bit, so perhaps there’s further still for the shares to fall. I just don’t know. And perhaps BRKR will have to revise down or pull their guidance for the year (although Q1 preliminary revenue came in stronger than expected). But I do believe that this extraordinary business has a vital role to play in the world and that its management will be able to adapt, come what may.

If you had bought BRKR in October 2012 when it lasted traded at 15x, you’d have compounded at ~19.5%% over the next five years - a time during which EPS compounded at ~12.5%. As it happens, today, management are signalling something pretty similar for the years ahead and they’re about as excited as they’ve ever been about the business. The share price, however, implies that investors anticipate a much worse outcome. Who’s right and who should we believe? I aim to address these questions here.

Keep reading with a 7-day free trial

Subscribe to Notes From The Beauty Contest to keep reading this post and get 7 days of free access to the full post archives.