WPP

...Multibagger?

Welcome to the second published stock idea, here at NFTBC. It’s WPP. For more context about this substack, please head over to the NFTBC intro piece. My gratitude to everyone who has read my work so far. If you like what you read, I would be grateful if you share it around. You can also find me on X/Twitter.

[Full disclosure: I have a mid-single digit percentage of my portfolio in WPP and I may dial up or down depending on how things evolve - as posited below. Disclaimer: my work is not intended to be advice - please do your own research].

Thesis

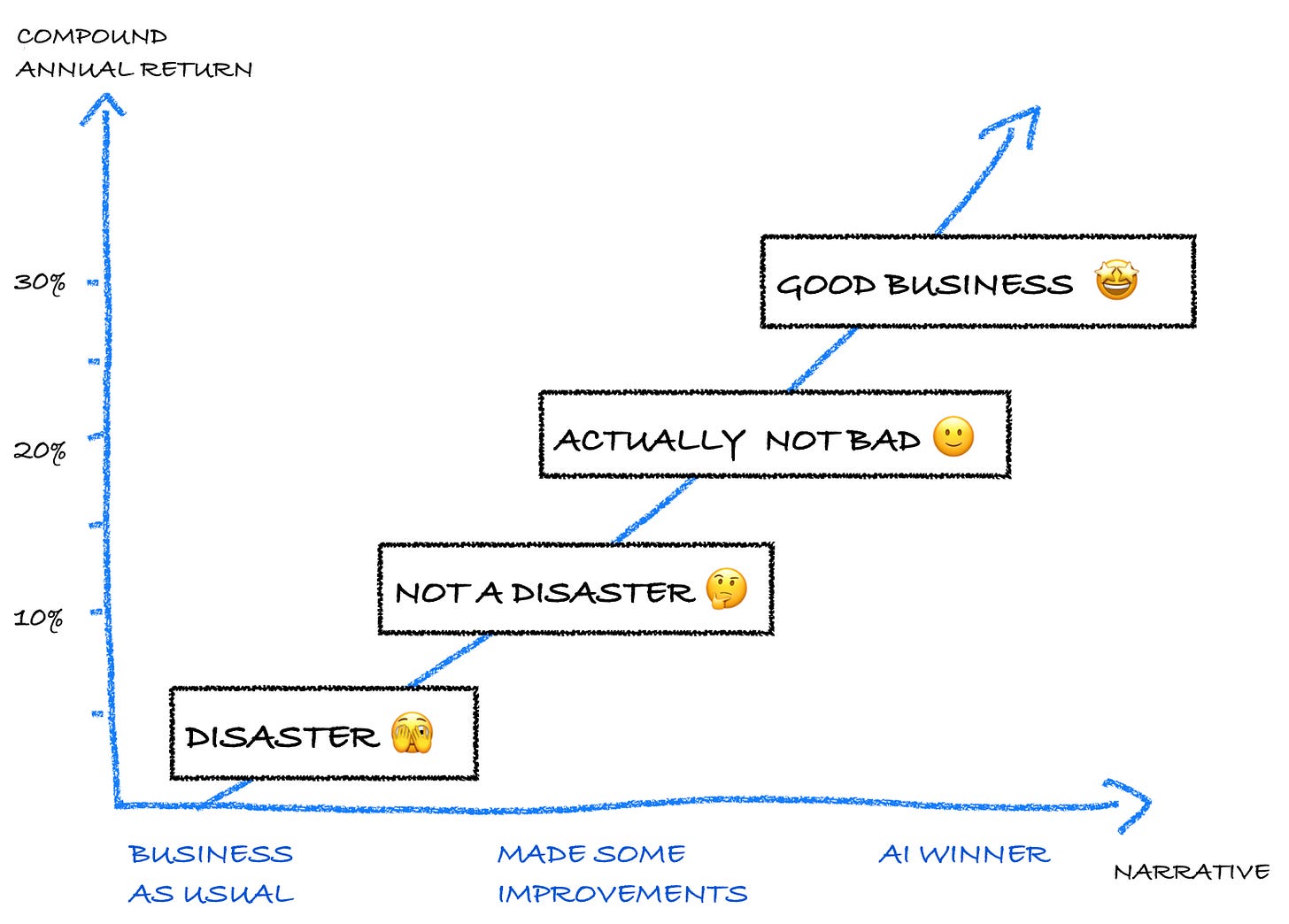

My thesis is conceptually quite simple, yet layered. The simple can be visualised in a graphic, but the layers will require more explanation. Here’s the graphic:

To boil it down, if WPP can prove itself merely to be ‘not a disaster’ then the returns from here should be decent - WPP is perceived to be the laggard in a tough industry, so expectations are very low. I would rate the odds of a narrative upgrade here as highly favourable. But things get more interesting the further we move up the curve. As we shall see, WPP has undergone years of heavy lifting, with the intention of improving its business and competitive position. If management can hit the pretty modest medium-term targets they have set, then the returns get better still. I still like the odds of this - I believe the evidence is mounting, even if not yet present in trailing numbers. Most interesting of all is the topic du jour: AI. As I set out in the NFTBC intro, I am particularly interested in unexpected beneficiaries of the AI revolution. I think WPP could be one of those. While the vast majority of businesses have been behaving reactively to events following the launch of ChatGPT in November 2022, WPP has been pushing on the AI door for years. Of legacy, non-digital native businesses, I haven’t found many that have been more proactive than WPP when it comes to AI, and perhaps genAI in particular. It’s not an exaggeration to say that WPP have put AI at the very centre of their business model.

The combined advertising, media and marketing industries have undergone many shifts over the decades - in the last 20 or so years such shifts have generally worked to the detriment of the legacy players. It’s generally assumed that future trends won’t be positive either. But WPP has been working hard to reassert its value and bargaining power within industry workflows, all within the context of a seismic AI-driven shift currently hitting the world at large. WPP’s management think that the marketing industry is on the verge of disruptive change and they intend to be a disruptor rather than the disrupted. If they get it right, then the revenue model of the industry could change, allowing for greater volumes of business and at higher margins. This part is less certain - it’s interesting and exciting but no one really know how things will unfold even if WPP’s ambitions are clear and its strategy coherent. I will be watching and updating as things progress.

Why WPP now? I think the inflection draws near. WPP has faced headwinds in the last couple of years and the share price implies these will be ongoing. Per CEO Mark Read, 2025 will be the “year of execution”. From the various signals we’ve had the business is about to start growing again, even if just moderately to begin with. We should therefore be able to build confidence this year as to whether we are taking the first step up the curve - perhaps we’ll learn more at WPP’s earnings event next week. To be clear, giant strides up the curve seem unlikely. If we do keep heading up the curve, it will be multi-year story - hence the provocative subtitle. As an illustration: 25% compound annual return for five years gets you into multibagger territory.